Are you a creator that has your dream job as your own boss making an income that fits your lifestyle? They promised it would feel good…and it does! But they forgot to leave out all of the things we’d be missing without a paycheck from a corporation. The biggest loss: a retirement account!

While your job as content manager, blogger, MUA, stylist, musician or whatever other creative gig you’ve found yourself may be feeding your soul today, but have you started planning on how you’re going to feed your body when you’re no longer bringing in an income?

I have to admit that I had not been. Between being an independent contractor, a freelancer, full time at a marketing agency, and then once again self-employed, not once had I started “putting anything away” for retirement. While I always tried to be smart with my money– saving 20% of everything I ever made and never getting into loans that would destroy my credit– I hadn’t started preparing for the day (far far in the future) when I’m unable to work, but don’t want to rely solely on social security (if it’s even still available decades from now). I built up a decent savings throughout my 20s, but left it in a bank’s saving account with interest of less than 2% each year. What a waste!

When Covid-19 hit and many of the businesses that I was scheduled to work with put campaigns on hold, I couldn’t help but think about how prepared I truly was for “not working” when that time actually came. A savings is great, but if you aren’t working and receiving a paycheck then you can’t continue to save. So how do I build on top of what I already have?

After talking to my fiancé I realized that the money I had saved should be doing more to prepare me for my future than sitting in a bank account (increasing morbidly slow)…which is how I decided to finally invest in the stock market.

The stock market is greatest creator of wealth the world has ever seen.

Each day the market opens at 9:30am and public trading begins. Some days stocks are up, some days they’re down. You can keep track of your “earnings + losses” of each day from whichever app you choose (I’m using TD Ameritrade, but Robin Hood has been really popular with other millennials). I put “earnings + losses” in quotations because the truth is you don’t win or lose until you sell; so it’s really just showing you where you stand. That matters because trading is a long-term game. It’s not about what happened over a span a week. It’s about what happened over the span of 5 years; or a decade. And since my plan is to use this as a source for retirement… what happens over the span of 4 decades.

Interested in trading in the stock market but don’t know where to start? This may help!

Stocks? Markets? Trading? I KNOW NOTHING. Where do I begin?

Before I began trading, I also knew very little about it. I created an account on the Ameritrade app, and before ever putting money in, I dedicated an hour or so and watched each of their educational videos– being sure to screenshot anything I thought I may need to remember. There were over a dozen of them and by the time I was through I felt like I had a much better grasp on the whole concept of “trading” within the stock market.

Why invest now?

The best time to invest in the market is anytime! But right now is a special time. Just like it has done with everything else, Covid-19 has affected the market. At the time of writing this blog post the majority of stocks were down, and that often plays in favor of first time investors. They’re attributing this dip solely on the fact that the world was forced to shut down for over a month. There’s strong belief that when life resumes to normal stocks (aka when there’s a vaccine) the chart will rise again, creating a V-shape. Not only will you not be able to find stocks this low (hopefully) again anytime soon, you’ll see a bigger return on your investment than those who first invested in these stocks say one year ago.

How Do I Buy a Stock?

There are many app options I’m sure, but I’ve been using is the Ameritrade app. They’re a reputable company that give you access to tons of educational videos and have a app with a straightforward dashboard that’s easy to track + operate.

How Do I “Watch Stocks”?

When you begin trading you’ll want to keep any eye on companies you’ve invested in + companies you may be thinking about investing in. To do so you’ll reference each company by letters they’re listed under on the New York Stock Exchange (NYSE). Favorite those companies on an app (I use the iPhone stocks app to watch stocks, but there are several to choose from). On a schedule of your choosing (anywhere from daily to monthly) look at what that company is trading and compare it to the number you either bought (or began watching) at. Keep note of when stocks move up and down and make decisions to buy/sell based on those movements + the news those companies share.

Who do I invest in?

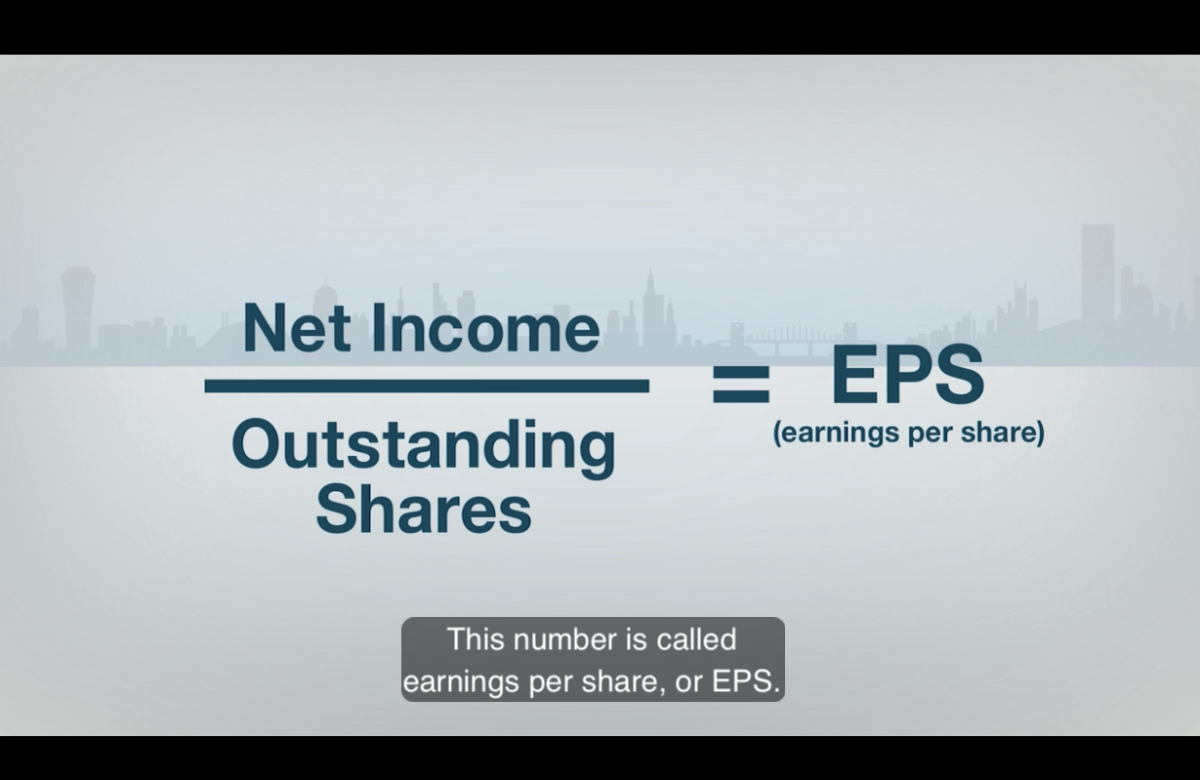

One of the concepts I really had to grasp was that you’re not buying companies you support, you’re buying the earnings for companies that you think are going to perform well. Read that again! Basically what I mean is you’re not buying Starbucks stock just because you go there 5x a week. Instead, you may be buying Mircosoft stock even though you don’t own a single product because you’ve seen that their earnings continue to increase because more companies are using their cloud service.

Tech companies historically make good returns because stocks prices rise in a (relatively) short time. The most prominent American tech companies are known as FAANG stocks: Facebook (F), Amazon (AMZN), Apple (AAPL) Netflix (NFLX), and Alphabet (GOOG). But don’t think that all tech companies are created equal. Remember the “.com bubble”? People invested everything into digital companies that were being overvalued and when projected earnings weren’t produced the bubble busted and people lost a lot. Choose internet companies that have been able to successfully monetize their audience, but don’t be afraid to choose companies from other industries. Medical companies are currently all looking for a vaccine for Covid-19. Finding medical advancements could increase a company’s earnings drastically so that may be a industry to keep an eye on right now! However, lots of medical companies were asked to give away their products without profit to control the health crisis, so that will also effect their worth.

How do I Know What’s Going on in the Stock Market?

If there’s a catch to making your money make money here it is… you have to read! Unless you’re paying someone to invest for you (and if you are I’m certain you wouldn’t be looking to me for advice) you’re going to have to keep up with the market. Reading articles from The Wall Street Journal, favoriting companies that you learn about + keeping an eye on their movement, and listening to news regarding publicly traded companies on CNBC is going to have to become apart of your routine. You’ll want to stay educated + informed. The best advice trading advice: buy on the rumor; sell on the news!

Why is investing better than a regular savings account?

The amount of interest your savings would make for you over a year (i.e., the money your money would make for you without you doing anything) compared to what you can make in one month of investing in the stock market can be pennies on the dollar. In just over one month of investing my savings has grown more than 10%. Thats more than what that money made in the nearly 10 years it was just sitting in my bank account.

Are there risks?

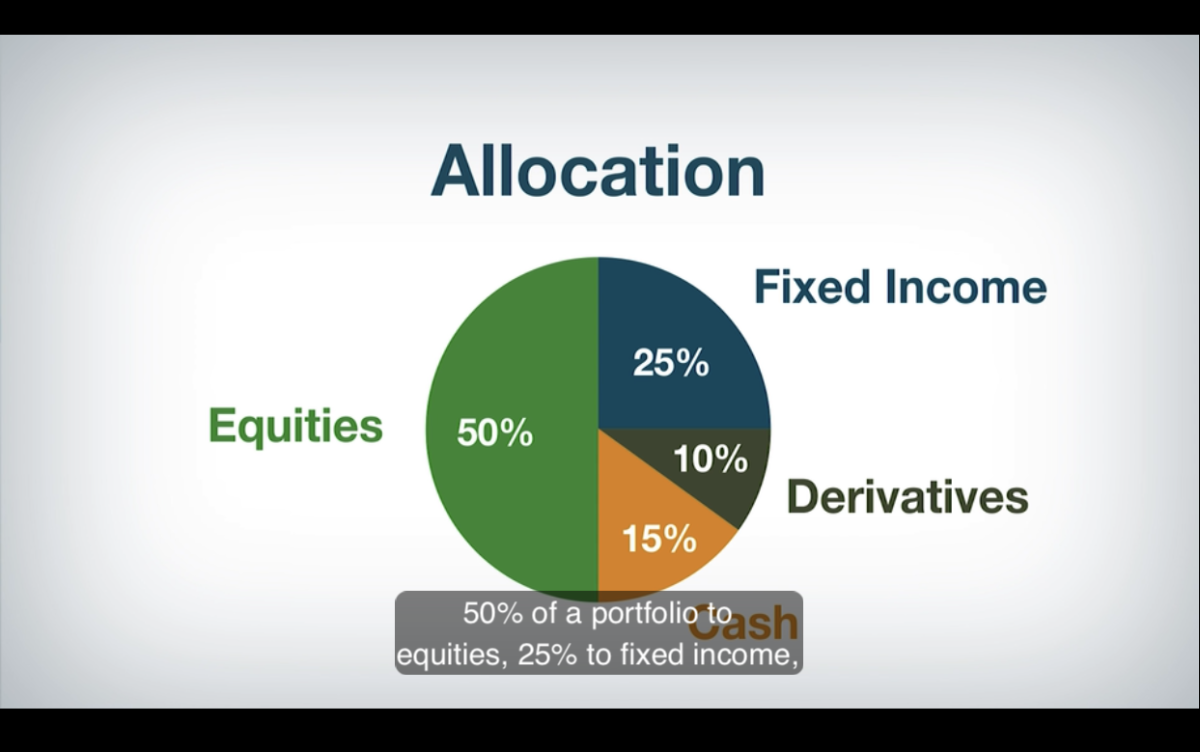

Most definitely! You can lose it all. But there are ways to avoid something like that from ever happening. Firstly, make sure you have a diverse portfolio. This means making sure you money is tied up in stocks (across many industries), bonds and commodities. But you should also keep any eye on your investments. You’ll need to know when to pull out, or even invest more! But don’t allow fear of losing money to stop you from taking risks for big returns. You only ever make or lose money when you sell!

How can investments work as your retirement account?

There are ways to officially tie your retirement account into the stock market, for which you’ll need a licensed broker. But if you’re just starting out and are wanting a feel for investing, you can count on it being money you can’t touch. I mean you can… If at any point you want your money you can transfer it out. But it’s not like a savings account that you can easily access with a bank card when you stumble across a pair of Louboutins you just can’t live without. This just helps ensure that right now it isn’t touched until you…well…retire!

*Note: My lawyer told me I needed to add a disclaimer stating that I am not a financial advisor, therefore, these are my opinions and not financial advice. Invest at your own risk!